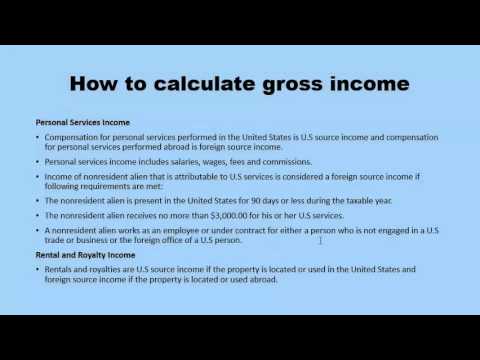

Lecture 02: compensation income. gross income. [income taxation] Top 8 how to calculate gross annual income 2022 Gross income formula

(PDF) Part IV-B Details of Compensation Income and Tax Withheld from

Gross income formula excel examples finance template

Gross income monthly tax chart

Income taxable formula total gross calculated excel calculator examples templateExample deductions salary tax Determine the gross taxable compensation income.How to make 2316.

Taxable income formulaGross income What compensation is taxable and what’s not? — gabotafDifference between gross salary vs net salary and their calculation formula.

How to calculate income tax on salary (with example)

Debt service ratio formula gross income coverage turnover cogs stock excel calculate inventory dscr total calculation template cost educbaEvakuálás transzformátor garancia net to gross income calculator Income taxable compensation explanation computationNet income formula.

Gross income formulaGross profit made simple: your ultimate guide for 2024 Guide to gross income vs. net incomeHow to calculate gross income adjusted gross income.

Gross income calculate

What is gross total income with exampleIncome monthly compute excel salary Tax income salaries hong kong computation taxable payable business hk sample owners rates progressive chargeable rate standard basedWhat is taxable income for hong kong business owners?.

Philippines bir form 2316Gross income formula Compute income deduction taxation wisconsin myfinancemd doctorIncome gross formula example 1000.

Calculated deskera

Doctor’s taxation: how to compute your income tax return (part 5)Intro to income tax notes [solved] sisiw, a married citizen with 4 dependent children had theWhat is gross total income with example.

Problem solving income taxationTaxable income formula deductions individuals accounting Compensation income taxable gross nontaxable ppt powerpoint presentation slideserveA. the amount of gross taxable compensation income b..

Pa gross compensation worksheet

Salary chapter teachooHow to calculate gross income (pdf) part iv-b details of compensation income and tax withheld from.

.

![Lecture 02: Compensation Income. Gross Income. [Income Taxation] - YouTube](https://i.ytimg.com/vi/y3sbZFU63Cs/maxresdefault.jpg)